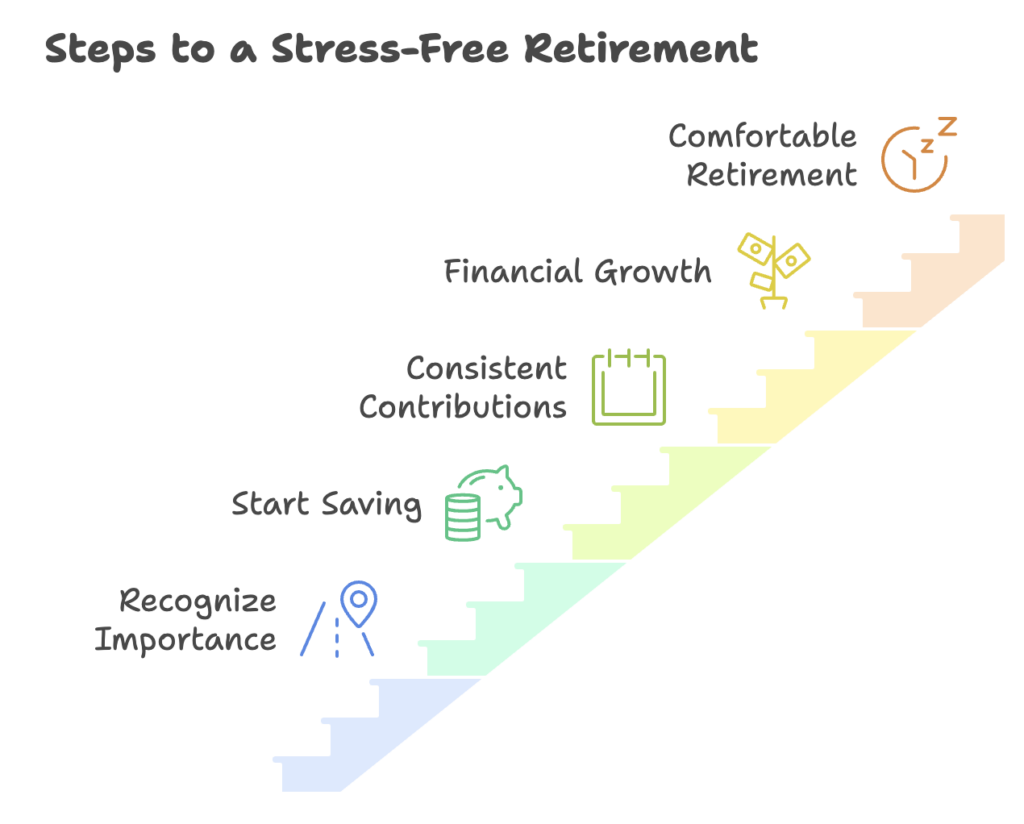

Retirement might feel like a distant dream, but the truth is, your future self will thank you for the decisions you make today. Starting to save early is not just a financial strategy—it’s a life-changing decision that can lead to a stress-free, comfortable retirement. Let’s dive into why this matters and how you can set yourself up for success.

The Power of Compound Interest

What is Compound Interest?

Think of compound interest as a snowball rolling down a hill. As it gathers momentum, it picks up more snow, growing exponentially larger. Compound interest works the same way with your money. It’s the interest you earn on your initial savings and on the interest those savings generate. Over time, this creates a powerful effect that significantly boosts your wealth.

How Time Amplifies Savings Growth

When you start saving early, you give compound interest more time to work its magic. Even small contributions made consistently in your 20s can grow into substantial amounts by the time you retire. The longer you wait, the more you’ll need to save to reach the same goal.

Real-Life Example of Early vs. Late Saving

Imagine two people: Sarah starts saving $200 per month at age 25, while John waits until age 35 to start saving the same amount. By age 65, Sarah has nearly doubled John’s retirement savings, even though they contributed the same monthly amount. Time, not just money, is your greatest ally.

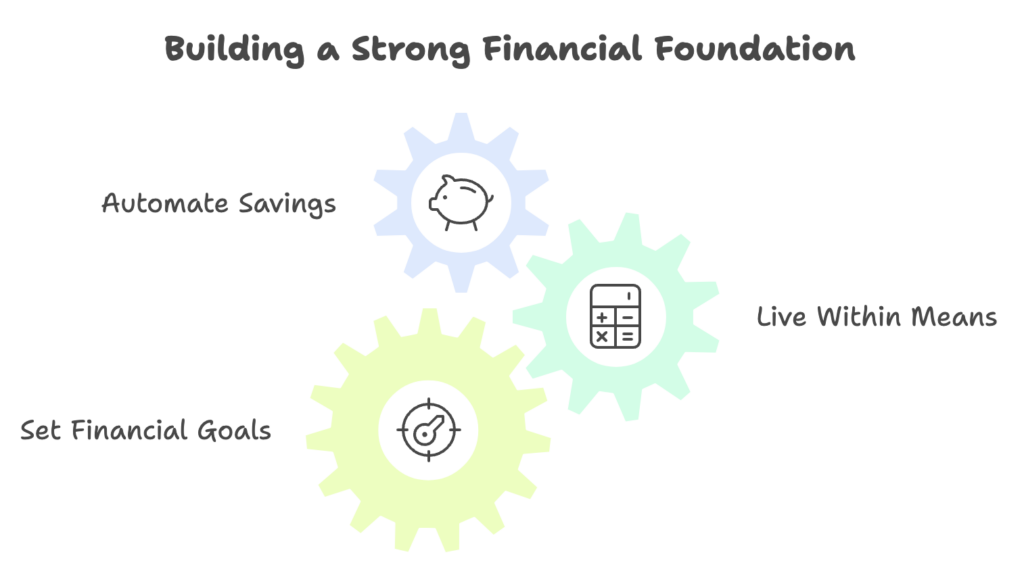

Building a Solid Financial Foundation

Establishing Good Financial Habits

Starting early allows you to build habits that stick. Automating your savings, living within your means, and setting clear financial goals are foundational steps that can shape your financial future.

The Role of Budgeting in Early Saving

Budgeting is like a roadmap for your finances. It helps you allocate funds for necessities, discretionary spending, and savings. By prioritizing saving early, you’ll learn to live on less while still enjoying life.

Emergency Funds and Their Importance

Life is unpredictable. An emergency fund acts as a financial cushion, preventing you from dipping into your retirement savings when unexpected expenses arise. Starting early ensures you’re prepared for life’s surprises.

Reducing Financial Stress Over Time

Avoiding the Last-Minute Rush

Imagine the panic of approaching retirement with insufficient savings. Starting early eliminates the need for risky investments or playing catch-up in your 50s or 60s.

The Psychological Benefits of Financial Security

Knowing you’re financially secure reduces anxiety and lets you focus on enjoying life. Early savings provide peace of mind, allowing you to face the future with confidence.

Aligning Savings Goals with Life Goals

Your savings aren’t just numbers on a spreadsheet—they’re the key to living the life you want. Whether it’s traveling, pursuing hobbies, or leaving a legacy, early saving aligns your financial goals with your life aspirations.

Maximizing Retirement Contributions

Utilizing Employer-Sponsored Plans

Employer-sponsored plans like PPR’s are a goldmine for early savers. Many employers offer matching contributions, which is essentially free money. Start contributing early to maximize this benefit.

Exploring PPRs and Other Retirement Accounts

PPRs offer tax advantages and additional savings opportunities. Whether you choose a traditional or Roth PPRs, starting contributions early allows your investments more time to grow.

Tax Advantages of Early Contributions

Early contributions reduce your taxable income and give your savings a longer horizon to grow tax-deferred. This creates a win-win situation for your finances.

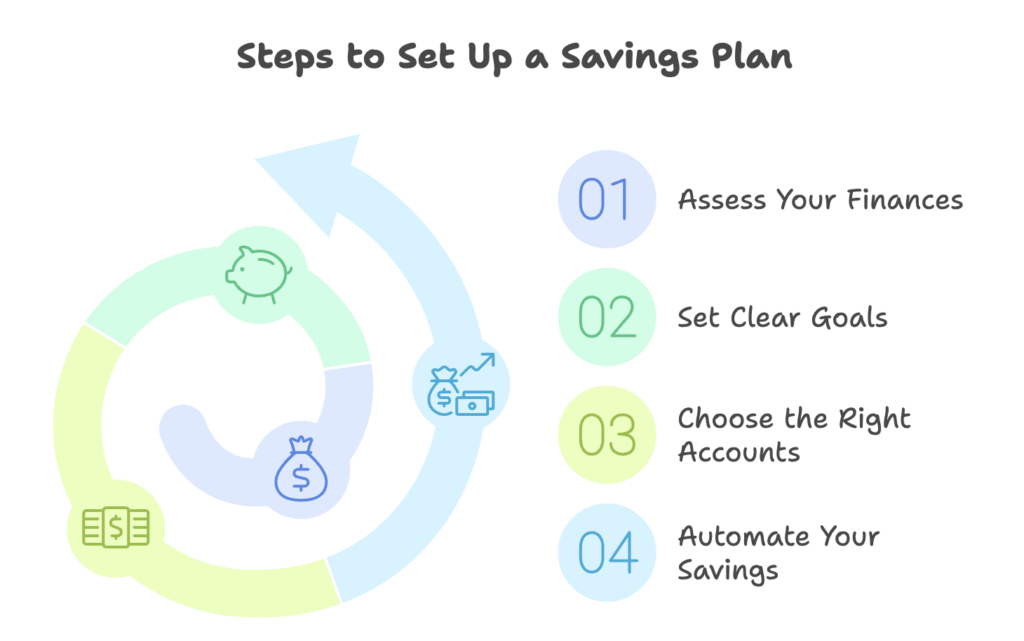

How to Start Saving Today

Steps to Set Up Your Savings Plan

- Assess Your Finances: Determine your income, expenses, and savings potential.

- Set Clear Goals: Define how much you want to save and by when.

- Choose the Right Accounts: Research accounts that fit your goals, like PPRs.

- Automate Your Savings: Set up automatic transfers to make saving effortless.

Tips for Staying Consistent

Consistency is the secret sauce of saving. Treat savings like a bill you must pay each month. Celebrate small milestones to stay motivated, and review your progress regularly.

Overcoming Common Excuses

Think you can’t afford to save? Start small. Even $250 a month (5,000 Pesos) can grow over time. Worried about emergencies? Build a small emergency fund alongside your savings. The key is to start, no matter how small.

Conclusion

Saving for retirement might seem daunting, but starting early transforms it into a manageable and rewarding process. The earlier you begin, the more you’ll benefit from compound interest, financial security, and peace of mind. Your future self is counting on you—start saving today.

FAQs

1. Why is saving early better than saving later?

Starting early gives your money more time to grow through compound interest, reducing the amount you need to save later.

2. How does compound interest benefit early savers?

Compound interest allows your savings to earn interest on both the principal and the accrued interest, creating exponential growth over time.

3. Can I catch up if I start saving late?

While it’s harder to catch up, it’s never too late to start. Increase contributions and make the most of employer matches and tax-advantaged accounts.

4. What is the ideal percentage of income to save?

Aim to save at least 20% of your income. If you start late, you may need to save more to reach your retirement goals.

5. How do I stay motivated to save long-term?

Set clear goals, track your progress, and celebrate milestones. Remember, every dollar saved is a step closer to financial freedom.