Definition of dollar-cost-averaging

dollar-cost-averaging (DCA) is a tried-and-true investment strategy where you invest a fixed amount of money into a particular asset, like stocks or mutual funds, at regular intervals. This systematic approach removes the need to “time the market” and ensures you consistently invest regardless of market conditions.

How It Works in Practice

Imagine you decide to invest $500 every month in a mutual fund. If the fund’s price per share drops, your $500 will buy more shares. If the price rises, you’ll buy fewer. Over time, this strategy averages out the cost of your investments, reducing the impact of market volatility.

The Philosophy Behind dollar-cost-averaging

The core idea is simple: markets fluctuate, but disciplined investing can help you avoid emotional decision-making. DCA aligns perfectly with the philosophy of steady and long-term wealth accumulation, making it a favorite among investors.

Benefits of dollar-cost-averaging

Reducing the Impact of Market Volatility

Markets are like roller coasters—they have ups and downs. DCA ensures you’re buying both during market dips (at lower prices) and peaks (at higher prices), which balances the overall cost of your investments.

Building a Disciplined Investment Approach

Life gets busy, and investing often takes a backseat. DCA automates the process. By setting a fixed amount to invest at regular intervals, you avoid procrastination and emotional swings that could derail your financial plan.

Achieving Long-Term Financial Goals

Whether you’re saving for retirement, a home, or your child’s education, DCA keeps you on track. Over time, consistent investments have the potential to grow significantly, thanks to compound interest and market appreciation.

Real-Life Examples of dollar-cost-averaging

Monthly Investment Scenarios

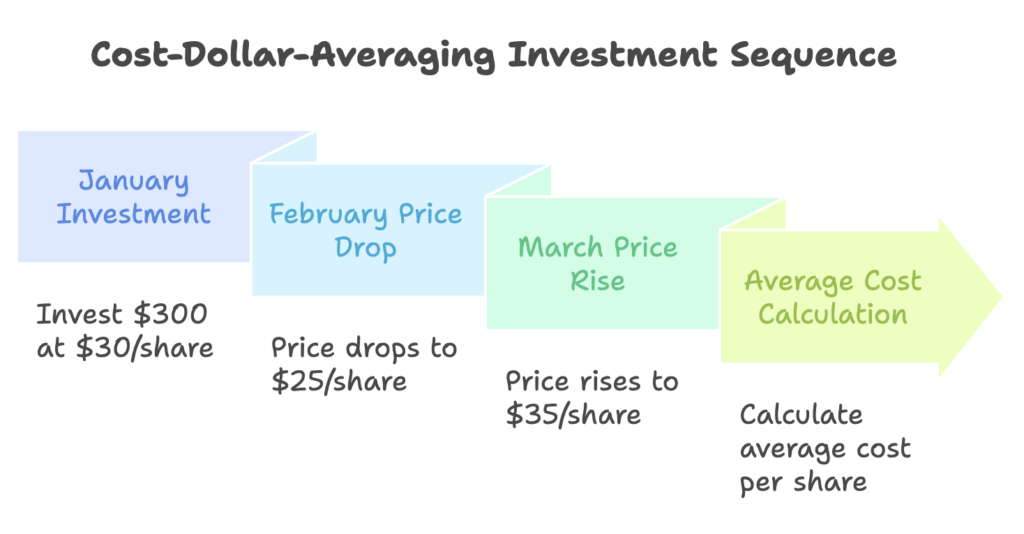

Let’s say you invest $300 monthly in an ETF. In January, the price per share is $30, so you buy 10 shares. By February, the price drops to $25, allowing you to purchase 12 shares. In March, it rises to $35, so you buy around 8.5 shares. Over three months, your average cost per share is lower than the market price.

Comparing Lump-Sum vs. dollar-cost-averaging

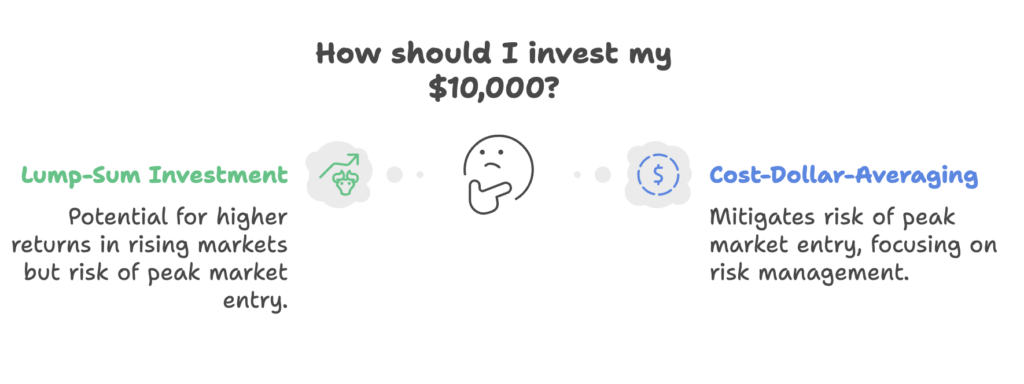

If you have $10,000 to invest, should you put it all in at once or spread it out? While lump-sum investing might yield higher returns in rising markets, DCA cushions the risk of entering the market at a peak. It’s about managing risk versus reward.

How the Strategy Plays Out Over Time

Historically, DCA has proven effective for long-term investors. It may not outperform in every market condition, but its power lies in its simplicity and the habit of consistent investing, especially during volatile times.

Drawbacks and Limitations

Potential Missed Opportunities

If markets are on a consistent upward trend, DCA might result in lower returns compared to investing a lump sum early on. However, this is often the trade-off for reduced risk.

Challenges During Rising Markets

When prices steadily increase, your fixed investment buys fewer shares over time. While this doesn’t negate the benefits of DCA, it can feel frustrating for those who want to maximize share accumulation.

Importance of Staying Consistent

The key to DCA’s success is consistency. Missing contributions or trying to outsmart the market by pausing your investments can undermine the strategy’s benefits.

How to Get Started with dollar-cost-averaging

Choosing the Right Investments

DCA works best with assets that have long-term growth potential, like diversified mutual funds, ETFs, or index funds. Avoid speculative assets that lack stability.

Setting Up a Regular Contribution Plan

Decide how much you can comfortably invest each month without disrupting your financial stability. Start small and increase contributions as your income grows.

Tools and Platforms to Simplify the Process

Many brokerage platforms allow you to set up automatic investments. Look for platforms with low fees, educational resources, and an easy-to-use interface to streamline the process.

Conclusion

dollar-cost-averaging simplifies investing, reduces risk, and promotes long-term financial growth. By committing to a consistent, systematic approach, you can overcome the challenges of market fluctuations and work steadily toward your financial goals. Start small, stay consistent, and let time do the heavy lifting.

FAQs

What is the primary goal of dollar-cost-averaging?

The primary goal is to reduce the risk of market volatility while building wealth steadily over time.

Can dollar-cost-averaging be used for all types of investments?

It’s best suited for long-term investments like mutual funds, ETFs, or index funds, rather than speculative assets.

What are the risks of dollar-cost-averaging?

The main risk is potentially lower returns during a consistently rising market compared to lump-sum investing.

How do I determine the right amount to invest regularly?

Assess your budget and financial goals. Start with an amount that doesn’t strain your finances, and increase contributions over time.

Is dollar-cost-averaging suitable for short-term goals?

No, DCA is more effective for long-term goals as it leverages the power of compounding and market fluctuations.