The Importance of Saving for Retirement

Why Start Early?

Time is your greatest ally when saving for retirement. Starting early allows you to take advantage of compound interest, where your earnings generate even more earnings over time.

Compound Interest and Its Power

Imagine planting a tree. The earlier you plant it, the more time it has to grow. Compound interest works the same way, letting your savings grow exponentially if given enough time.

Mistake #1: Starting Too Late

Consequences of Procrastination

Waiting too long to start saving means you’ll have to contribute significantly more to catch up. You may also miss out on years of compound growth.

How to Catch Up if You Started Late

It’s never too late to begin. Increase your contributions, reduce unnecessary expenses, and maximize any employer matches to bridge the gap.

Mistake #2: Not Having a Retirement Plan

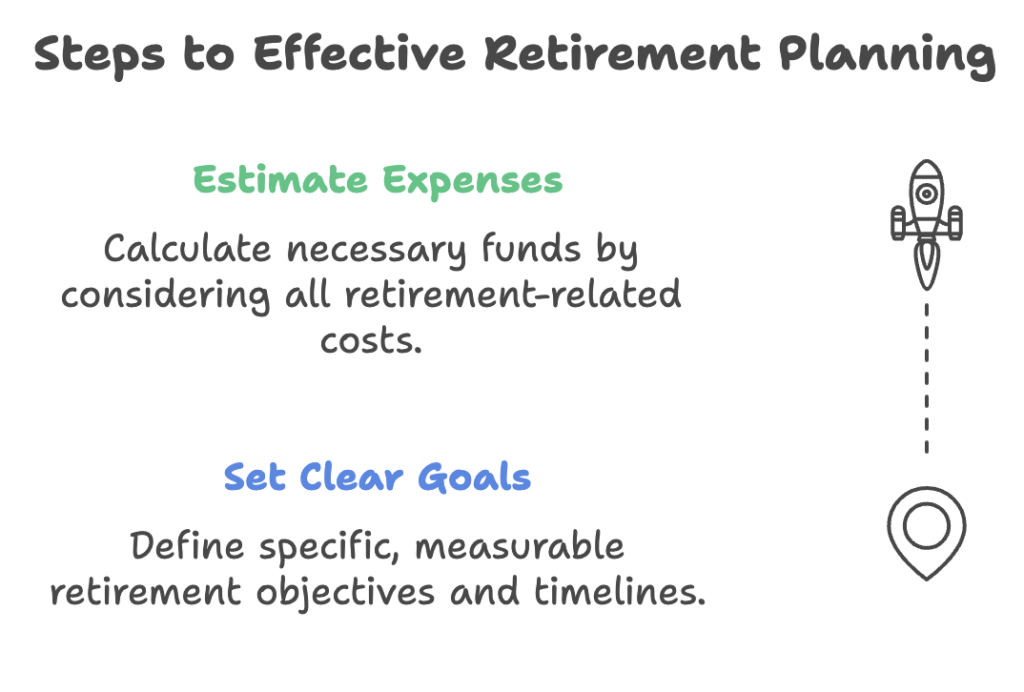

Setting Clear Goals

A vague idea of “saving for retirement” isn’t enough. Set clear, measurable goals for your retirement lifestyle and timeline.

Estimating Retirement Expenses

Factor in housing, healthcare, travel, and daily living expenses to understand how much you’ll need.

Mistake #3: Relying Solely on Social Security (IMSS)

The Limits of Social Security

Social Security isn’t designed to be your only source of income. At best, it covers a fraction of what most retirees need.

Why Diversifying Income Streams Is Critical

Investments, pensions, and personal savings provide the additional income you’ll require to maintain your lifestyle.

Mistake #4: Neglecting Employer-Sponsored Plans

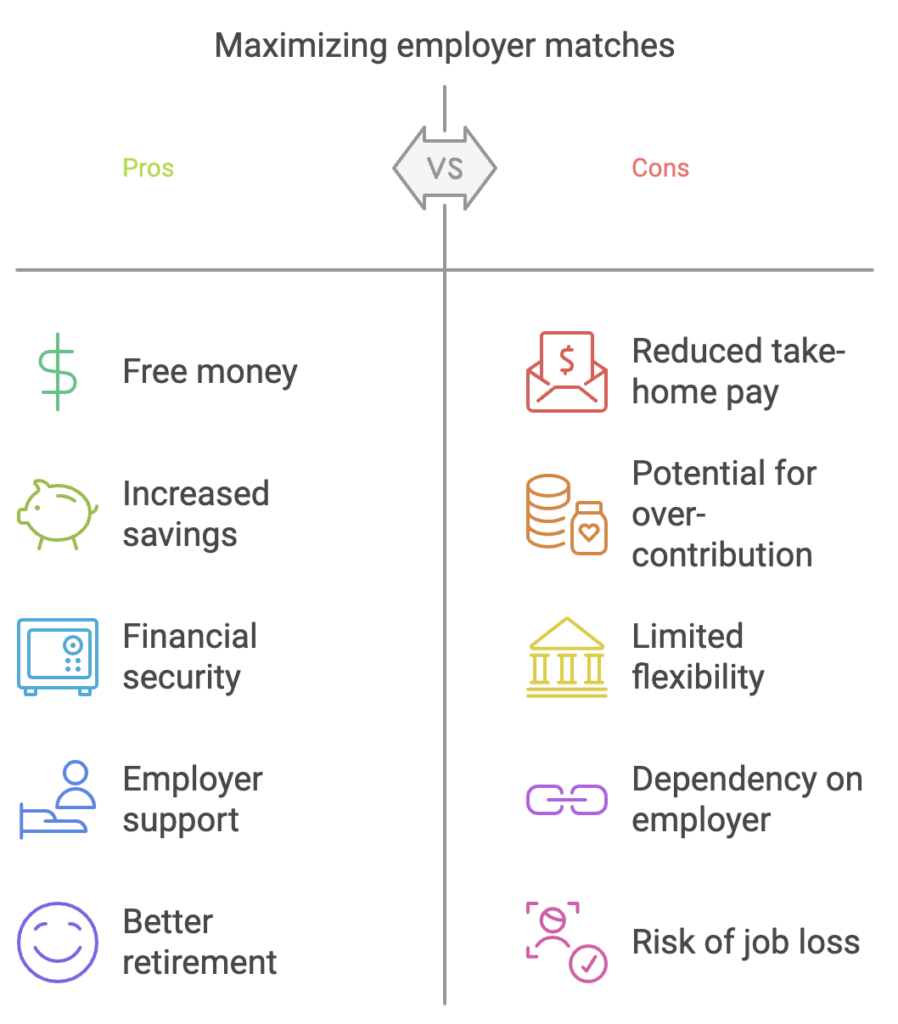

Missing Out on Employer Matches

Employer matches are essentially free money. Failing to contribute enough to earn the full match is like leaving money on the table.

Underutilizing Contribution Limits

Maximize your contributions to PPPs or similar plans to take full advantage of tax benefits and compound growth.

Mistake #5: Withdrawing Early from Retirement Accounts

Penalties and Tax Implications

Withdrawing early often results in hefty penalties and taxes, reducing your nest egg significantly.

The Opportunity Cost of Early Withdrawals

Early withdrawals also mean you lose out on potential growth, setting your retirement savings back even further.

Mistake #6: Failing to Diversify Investments

The Risks of Putting All Eggs in One Basket

Relying on a single investment type can backfire if the market takes a downturn. Diversification helps spread out risk.

Creating a Balanced Portfolio

Include a mix of stocks, bonds, and other assets tailored to your risk tolerance and retirement timeline.

Mistake #7: Ignoring Inflation

How Inflation Erodes Buying Power

Inflation can dramatically reduce the purchasing power of your savings over time. What costs $1,000 today may cost $2,000 in 20 years.

Adjusting Your Savings to Account for Inflation

Invest in growth-oriented assets to help your portfolio keep pace with or outpace inflation.

Mistake #8: Not Seeking Professional Advice

The Value of Financial Advisors

A good financial advisor can provide personalized strategies, saving you time and avoiding costly mistakes.

How to Find the Right Advisor

Seek out an independent financial advisor who isn’t tied to any specific company or product. This ensures they can provide unbiased guidance tailored to your unique financial goals, without any conflict of interest.

Mistake #9: Overestimating Future Income

Why You Need a Realistic Approach

Assuming you’ll earn more in the future can lead to under-saving today. Plan conservatively to avoid unpleasant surprises.

Preparing for Unexpected Expenses

Life is unpredictable. Build a buffer into your savings to handle emergencies without dipping into retirement funds.

Mistake #10: Failing to Update Your Plan Regularly

Adapting to Life Changes

Major life events—marriage, kids, career changes—can impact your retirement plan. Adjust accordingly.

Reviewing Investments Periodically

Markets fluctuate, and your risk tolerance may change. Review your portfolio annually to ensure it aligns with your goals.

How to Avoid Common Retirement Savings Mistakes

Creating a Savings Checklist

A checklist helps you stay on track with contributions, investment reviews, and goal-setting.

Utilizing Technology and Apps

Apps like Mint or Personal Capital make it easier to track progress and stay disciplined.

The Long-Term Benefits of Avoiding These Mistakes

Financial Security in Retirement

Avoiding these pitfalls ensures you’ll have the resources to live comfortably and enjoy your golden years.

Enjoying a Stress-Free Retirement

With solid planning, you can focus on travel, hobbies, and family without financial worries.

Conclusion

Retirement planning isn’t a sprint; it’s a marathon. Avoiding these common mistakes can make all the difference between a secure retirement and financial stress. Start now, stay consistent, and adjust your plan as life unfolds.

FAQs

1. What’s the best age to start saving for retirement?

The earlier, the better! Starting in your 20s gives you decades for compound interest to work its magic.

2. Can I retire comfortably if I start saving at 40?

Yes, but you’ll need to save aggressively and maximize investment growth to make up for lost time.

3. How much of my income should I save for retirement?

Aim for 20% of your income, but adjust based on your age, goals, and current savings.

4. What happens if I withdraw from my PPP early?

You’ll face penalties, taxes, and lose out on potential growth, making it a costly decision.

5. Do I really need a financial advisor for retirement planning?

While not mandatory, a financial advisor can provide valuable guidance and help avoid costly mistakes.