Why a Retirement Budget Is Essential

Retirement is a major life milestone, but it comes with its own set of financial challenges. A well-thought-out budget ensures that your golden years are financially secure and stress-free.

The Benefits of Planning Ahead

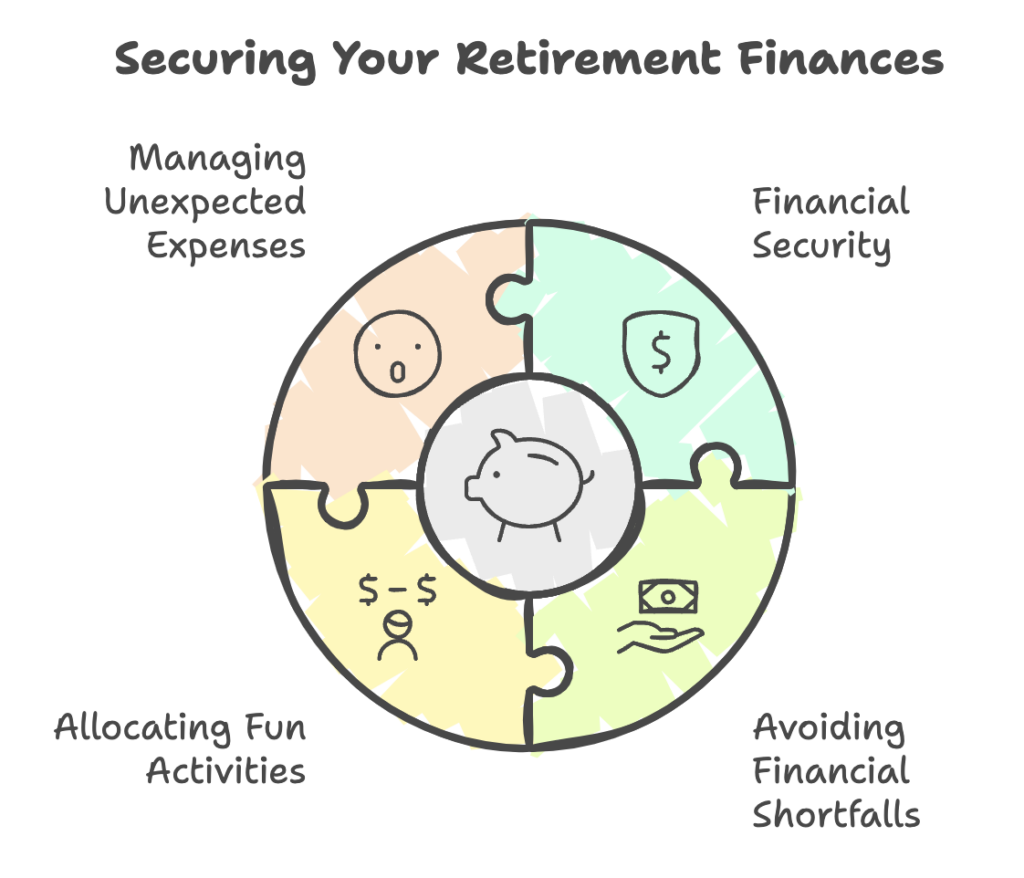

By creating a retirement budget, you can avoid running out of money, make room for the fun stuff like travel, and handle unexpected expenses with ease.

Understanding Your Retirement Needs

Estimating Monthly Living Expenses

Start by listing all your monthly costs—think housing, groceries, utilities, and insurance. This gives you a clear picture of your basic needs.

Accounting for Healthcare Costs

Healthcare can be one of the biggest expenses in retirement. Make sure to include premiums, co-pays, and out-of-pocket costs in your budget.

Including Leisure and Travel Plans

Retirement is your time to enjoy life! Whether it’s vacations or hobbies, plan for these activities so you can afford the experiences you’ve dreamed about.

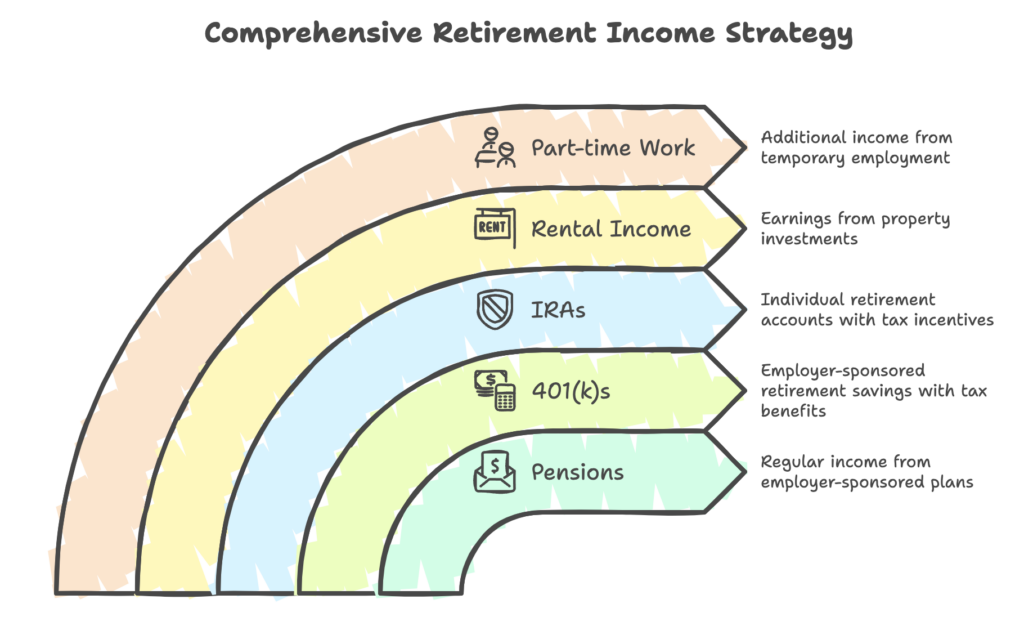

Assessing Your Retirement Income

Social Security Benefits

Estimate how much you’ll receive from Social Security. Use the Social Security Administration’s online tools to calculate your benefits based on your retirement age.

Pensions and Retirement Accounts

Factor in income from pensions, IMSS, PPRs, and other retirement savings. Make sure you understand the withdrawal rules to avoid penalties.

Alternative Income Streams

Consider other sources like rental income, part-time work, or annuities to supplement your retirement funds.

Common Mistakes to Avoid

Underestimating Healthcare Costs

Many retirees overlook rising healthcare expenses. Plan for long-term care insurance or higher medical costs as you age.

Ignoring Inflation

Don’t forget that the cost of living increases over time. A budget that works today might not cover your expenses 10 years down the line.

Overestimating Investment Returns

While investments can grow your savings, it’s risky to rely on overly optimistic returns. Be conservative in your estimates.

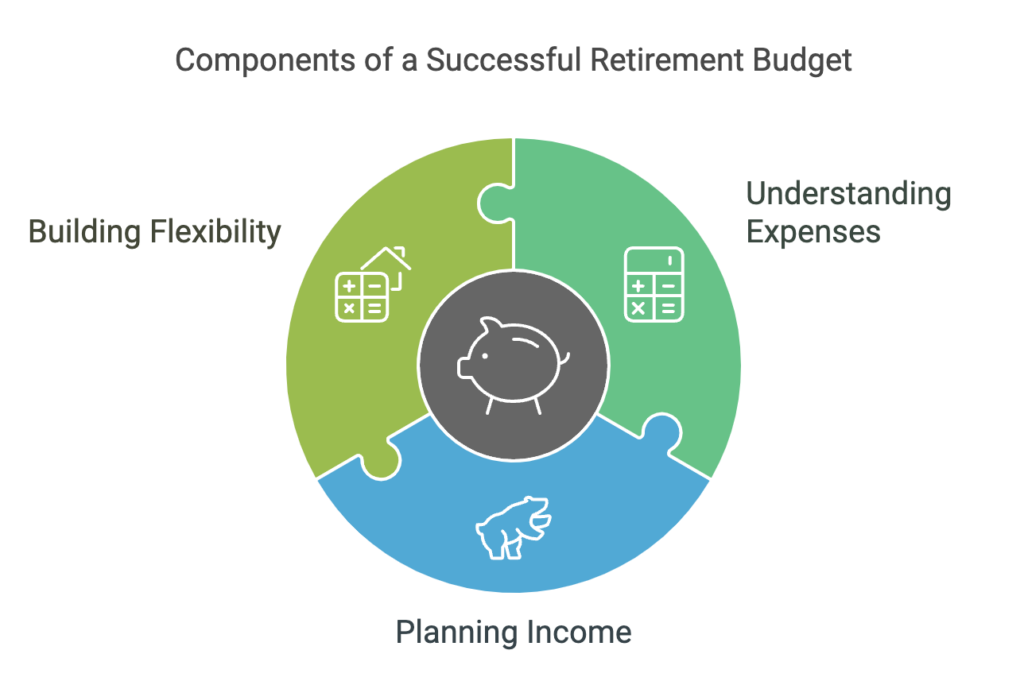

Steps to Build Your Retirement Budget

Step 1: Calculate Your Fixed Costs

Fixed expenses like rent, insurance, and utilities form the foundation of your budget. These are the must-pay bills every month.

Step 2: Identify Variable Expenses

Variable costs include groceries, entertainment, and dining out. Track your spending to get an accurate picture.

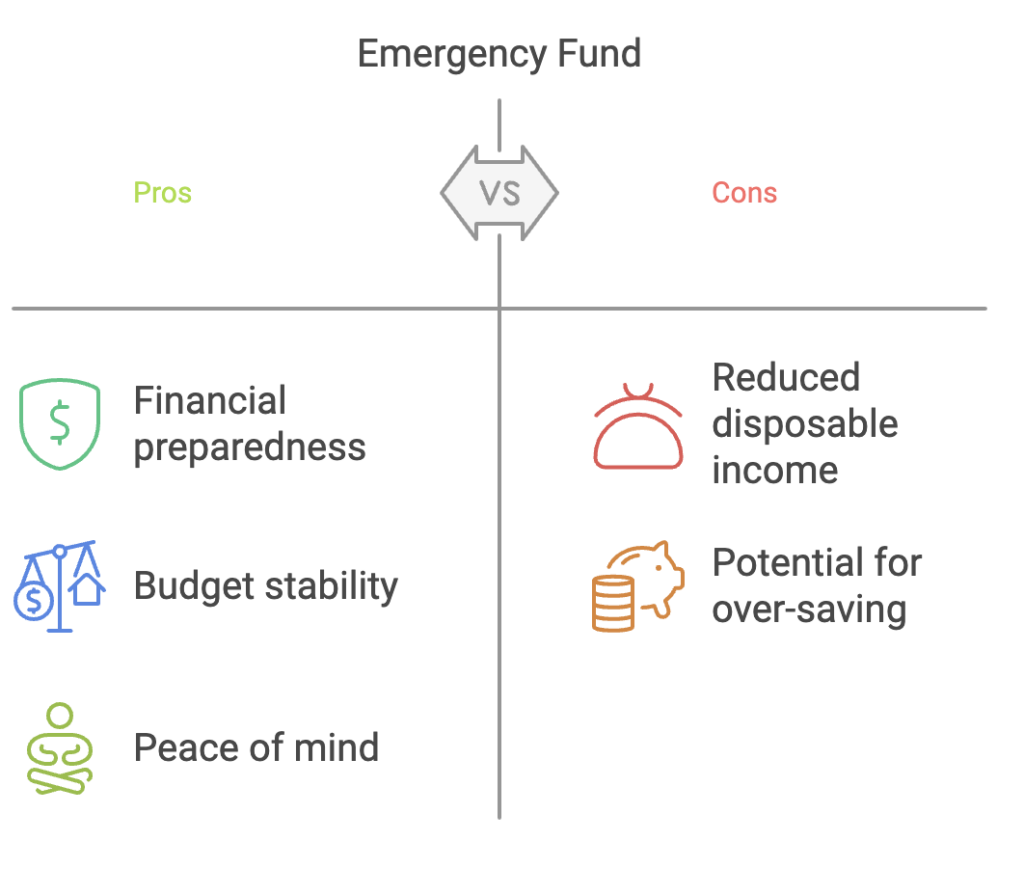

Step 3: Set Aside an Emergency Fund

Life is full of surprises. Having an emergency fund ensures you’re prepared for unexpected expenses without derailing your budget.

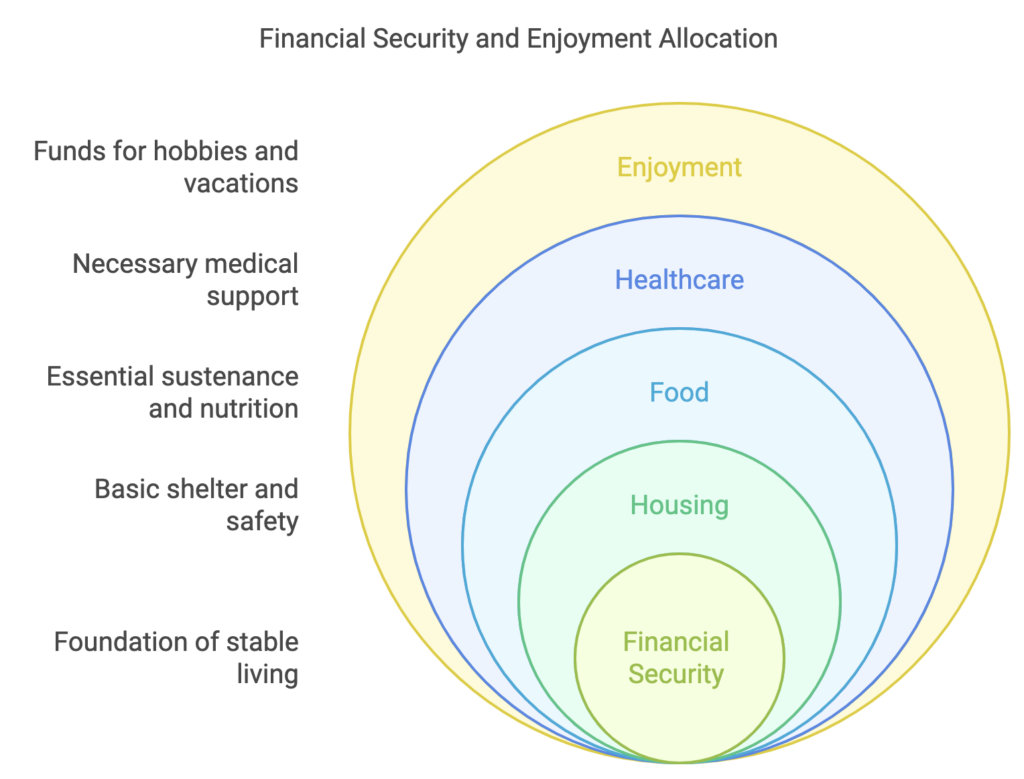

Balancing Needs vs. Wants

Prioritizing Essential Expenses

Cover your necessities first—housing, food, healthcare. These are the backbone of your financial security.

Allocating Funds for Enjoyment

Once your essentials are covered, allocate funds for hobbies, vacations, and other enjoyable activities.

Adjusting for Uncertainty

Planning for Unexpected Expenses

Build a cushion into your budget to handle emergencies like home repairs or medical bills.

Building Flexibility Into Your Budget

Your financial situation may change. Leave room to adjust your spending as needed.

Using Tools and Resources

Budgeting Apps for Retirees

Apps like Mint, Personal Capital, or YNAB (You Need a Budget) make it easy to track expenses and stick to your plan.

Working with a Financial Planner

A financial planner can provide personalized advice and help you optimize your budget for long-term success.

Tracking and Reviewing Your Budget

How Often to Review Your Budget

Check your budget monthly or quarterly to ensure you’re staying on track. Regular reviews help you catch issues early.

Adjusting for Lifestyle Changes

Retirement often brings changes. Update your budget if your living situation, health, or income shifts.

Tips for Sticking to Your Budget

Avoiding Impulse Spending

It’s easy to overspend when you have free time. Practice mindful spending and stick to your financial goals.

Automating Payments and Savings

Set up automatic payments for bills and savings to avoid late fees and ensure consistency.

Benefits of a Well-Planned Retirement Budget

Financial Peace of Mind

Knowing your finances are in order helps reduce stress and lets you enjoy retirement to the fullest.

Freedom to Enjoy Retirement

With a solid budget, you can pursue your passions and live the lifestyle you’ve always wanted without worrying about money.

Conclusion

Creating a retirement budget is the key to a stress-free and enjoyable retirement. By understanding your expenses, planning your income, and building flexibility into your budget, you can ensure financial stability and freedom throughout your golden years. Start today and give yourself the peace of mind you deserve.

FAQs

What percentage of my income should I save for retirement?

Experts recommend saving at least 20% of your income during your working years, but adjust based on your retirement goals.

How do I account for healthcare in my retirement budget?

Include premiums, co-pays, medications, and an allowance for long-term care or unforeseen medical expenses.

What’s the best tool to track my retirement budget?

Apps like Mint, YNAB, or Personal Capital are great for managing and tracking retirement budgets.

Should I include an emergency fund in my budget?

Absolutely! An emergency fund helps you cover unexpected costs without disrupting your regular expenses.

How can I adjust my budget if my income changes?

Review your expenses, prioritize needs over wants, and make cuts where necessary to align your budget with your new income.