Planning for retirement often feels like staring at a never-ending math problem. How much money is enough? It’s not a one-size-fits-all answer. Retirement looks different for everyone—some dream of sipping margaritas on the beach, while others are content gardening in their backyard. In this guide, we’ll break down the puzzle of retirement savings and help you figure out what’s best for your unique situation.

Understanding Retirement Expenses

Basics of Retirement Budgeting

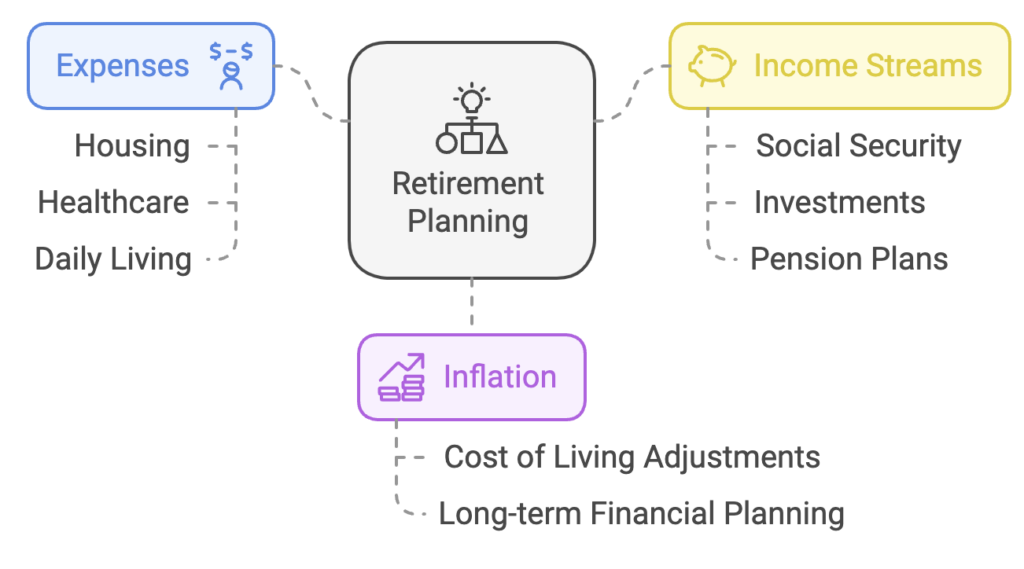

The first step in planning is understanding your future expenses. Think about your day-to-day costs now. How might they change when you retire? While some expenses, like commuting, may disappear, others, such as healthcare, can skyrocket.

Fixed vs. Variable Expenses in Retirement

- Fixed Expenses: These are your must-haves, like housing, utilities, and insurance.

- Variable Expenses: Think hobbies, travel, or dining out—things you can tweak if needed.

The Impact of Inflation on Retirement Savings

A dollar today won’t stretch as far in 20 years. Historically, inflation averages around 2-3% annually. Planning with inflation in mind ensures you don’t underestimate your needs.

Factors That Determine Retirement Needs

Your Desired Lifestyle

Do you envision frequent travel or a quiet life at home? Your lifestyle choices heavily impact how much you’ll need.

Health and Medical Costs

Healthcare is a wildcard in retirement planning. Premiums, medications, and potential long-term care can add up quickly.

Longevity: How Long Will You Need the Money?

The longer you live, the more you’ll need. While it’s hard to predict, err on the side of caution by planning for a long retirement.

Common Retirement Savings Rules

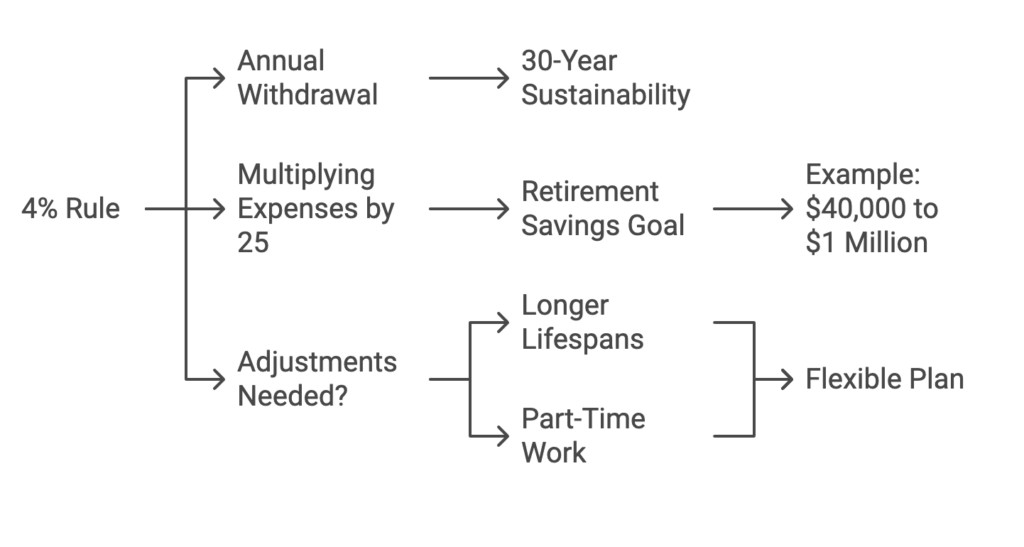

The 4% Rule Explained

The 4% rule is a popular guideline suggesting you withdraw 4% of your portfolio annually to sustain your savings for 30 years.

Multiplying Your Annual Expenses by 25

This rule-of-thumb estimates how much you need to retire. If you spend $40,000 annually, you’d aim for $1 million in savings.

Adjustments for Modern Retirement Trends

The traditional rules are helpful but might not fit everyone. People are living longer and working part-time in retirement, so you may need a more flexible plan.

Sources of Retirement Income

Instituto Mexicano del Seguro Social (IMSS) Benefits

For many, IMSS forms a significant part of retirement income. The amount depends on your work history and when you start claiming benefits.

Employer-Sponsored Retirement Plans

Plan Personal de Retiro and pensions can provide a solid foundation. Don’t forget to take advantage of employer matching if offered.

Personal Savings and Investments

PPRs, brokerage accounts, and savings are key pieces of the puzzle. The earlier you start, the more time your money has to grow.

Passive Income Streams

Think rental properties, dividends, or royalties. Passive income can offer financial freedom in retirement.

Tools for Calculating Your Retirement Needs

Online Retirement Calculators

These tools make it easy to input your goals and get an estimate. They’re a great starting point but shouldn’t replace professional advice.

Working with a Financial Planner

A financial planner can tailor a retirement strategy to your specific situation, helping you navigate complexities like taxes and investments.

DIY Planning: A Step-by-Step Guide

For the hands-on approach, list all potential expenses, factor in inflation, and consider multiple income streams.

Strategies to Reach Your Retirement Goals

Start Saving Early

The sooner you begin, the more you’ll benefit from compound interest—a snowball effect for your savings.

Investing Wisely

Balance risk and reward by diversifying your investments. Consider a mix of stocks, bonds, and other assets.

Reducing Debt Before Retirement

Debt is a retirement killer. Pay off high-interest loans and credit cards before leaving the workforce.

Real-Life Scenarios and Examples

Case Study: A Frugal Retiree

Meet Sarah, who lives modestly on $30,000 a year. Her focus on low-cost hobbies and simple living allows her to retire comfortably with $750,000.

Case Study: The Luxury Lifestyle Retiree

Contrast this with Tom, who enjoys fine dining and world travel. He needs a portfolio of $2.5 million to sustain his $100,000 annual spending.

Conclusion

Retirement planning is as much about knowing yourself as it is about numbers. By understanding your goals, expenses, and income sources, you can create a strategy that ensures a comfortable and fulfilling retirement. Start early, revisit your plan often, and don’t hesitate to seek professional advice.

FAQs

- How does inflation affect retirement savings?

Inflation reduces purchasing power, meaning you’ll need more money over time to maintain the same lifestyle. - What if I retire earlier than planned?

You’ll need to save more beforehand or adjust your lifestyle to stretch your savings. - Can I rely solely on Instituto Mexicano del Seguro Social?

No, Instituto Mexicano del Seguro Social is designed to supplement, not replace, retirement income. - How do I handle unexpected expenses in retirement?

Building an emergency fund within your retirement savings is crucial for unforeseen costs. - What are the biggest mistakes people make when planning for retirement?

Common mistakes include underestimating expenses, ignoring inflation, and relying too heavily on Instituto Mexicano del Seguro Social.