What is Early Retirement?

Defining Early Retirement

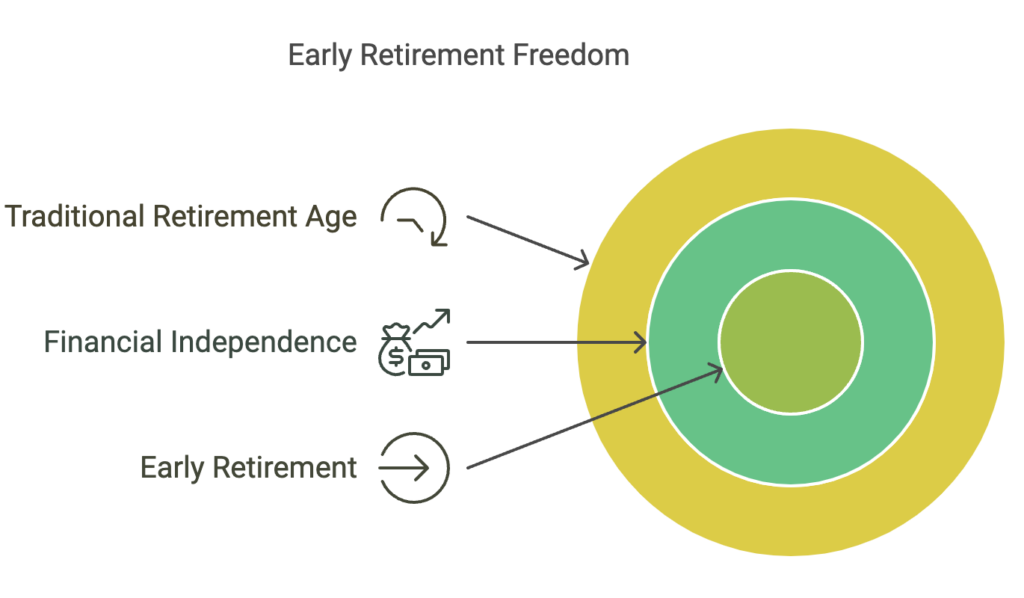

Early retirement is the decision to leave the workforce well before the traditional retirement age of 65. For some, this means retiring in their 50s, while others aim for financial independence by their 40s or even earlier. It’s not just about quitting your job—it’s about gaining the freedom to design your life on your terms.

Why Early Retirement Appeals to Many

The allure of early retirement is undeniable. Imagine swapping the daily grind for more time with loved ones, the flexibility to pursue hobbies, or the opportunity to travel the world. It’s about taking control of your time—a resource more valuable than money.

The Pros of Early Retirement

More Time for Hobbies and Passions

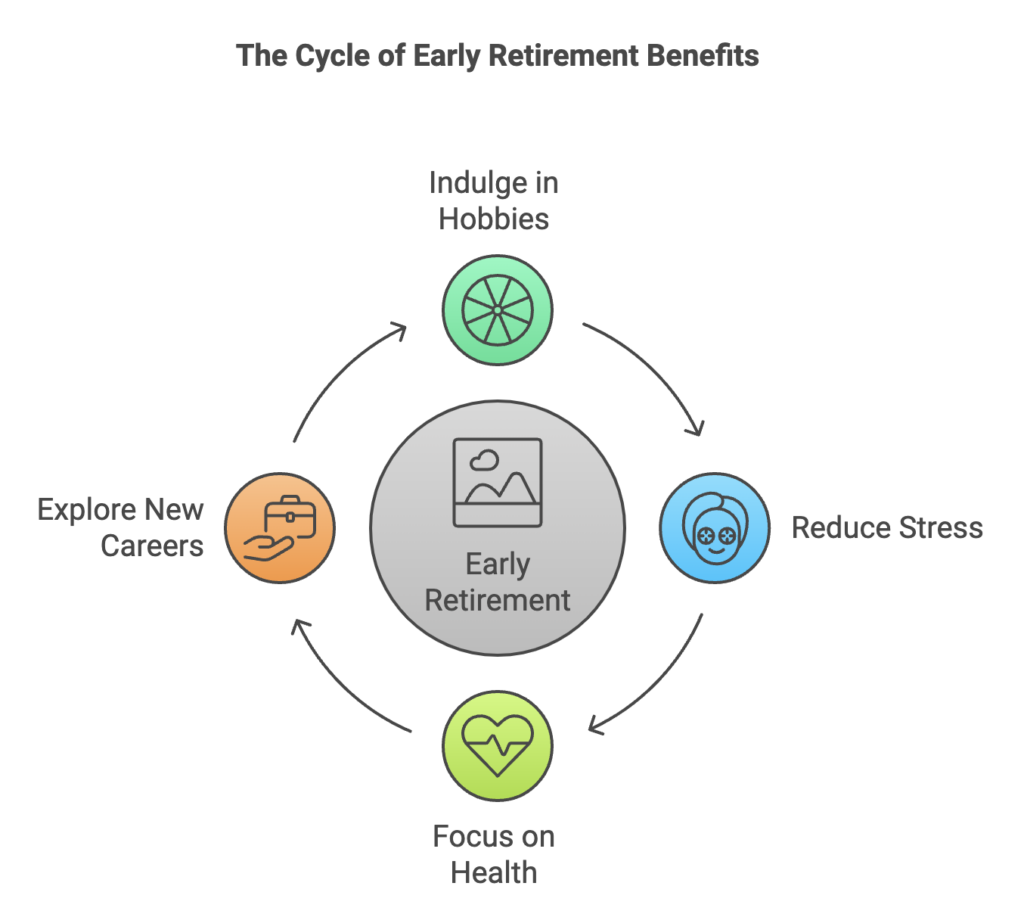

Early retirement offers a chance to indulge in activities that may have taken a backseat during your working years. Whether it’s painting, gardening, or learning a new language, early retirees often find renewed purpose in their passions.

Improved Health and Well-Being

Retirement can significantly reduce stress levels. With fewer work-related pressures, you’ll have more time to focus on physical and mental health. From exercising regularly to adopting a balanced diet, early retirement can be the ultimate health boost.

Opportunity to Pursue a Second Career or Volunteer Work

Early retirees often use their newfound freedom to explore second careers or volunteer in areas close to their hearts. This allows for continued personal growth and the satisfaction of giving back to the community.

The Cons of Early Retirement

Financial Challenges and Risks

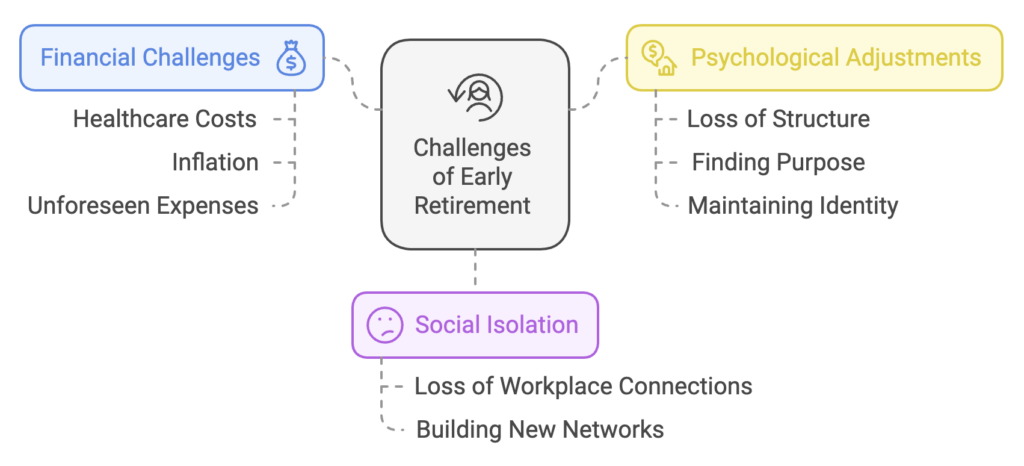

Retiring early means funding a longer retirement period. Without a well-planned financial strategy, you could outlive your savings. Healthcare costs, inflation, and unforeseen expenses add to the challenge.

Loss of Workplace Social Connections

For many, work is a source of social interaction. Retiring early can lead to feelings of isolation if you don’t actively maintain or build new social networks.

Psychological Adjustments to a New Lifestyle

Transitioning to retirement can be harder than it looks. The loss of structure, purpose, and identity tied to your career may take time to adjust to.

How to Achieve Early Retirement

Setting Clear Financial Goals

The first step is determining how much money you’ll need to retire comfortably. Consider factors like annual expenses, desired lifestyle, and long-term goals. Tools like retirement calculators can help.

Leveraging Investment Strategies

The 4% Rule and Its Application

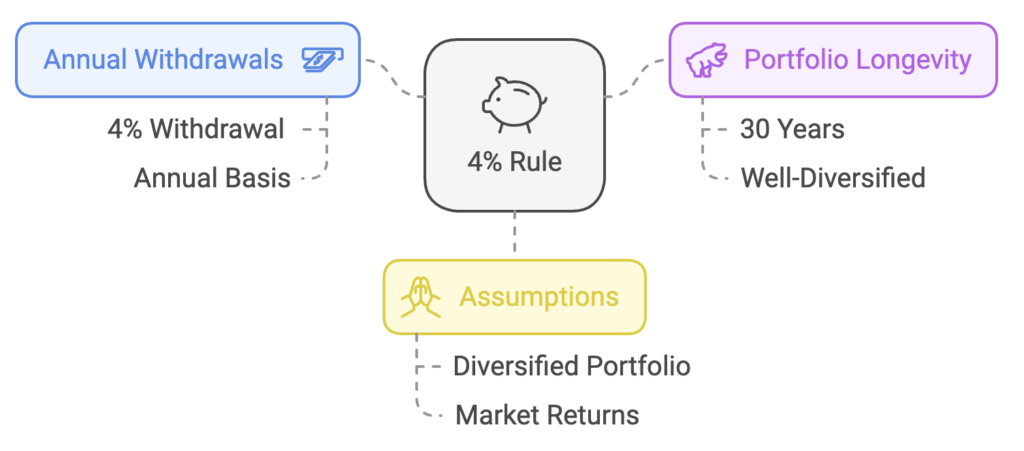

A popular rule of thumb in retirement planning is the 4% rule, which suggests withdrawing 4% of your savings annually. This approach helps ensure your funds last for 30 years or more, assuming a well-diversified portfolio.

Importance of Diversified Portfolios

Investing in a mix of stocks, bonds, real estate, and other assets spreads risk and enhances returns. A diversified portfolio is key to weathering market volatility over the long term.

Practicing Frugality and Budgeting

Cutting unnecessary expenses and living below your means accelerates savings. Adopting a minimalist lifestyle now can pay off with financial freedom later.

Exploring Alternative Income Sources

Consider side hustles, rental properties, or passive income streams like dividends. These can supplement your savings and reduce the financial strain of early retirement.

Is Early Retirement Right for You?

Assessing Your Financial Readiness

Before taking the plunge, evaluate whether your savings can sustain your lifestyle. Consult with a financial advisor to understand potential risks and create a retirement income plan.

Understanding Personal and Family Goals

Retirement isn’t just a financial decision—it’s a personal one. Discuss your plans with family members and ensure your goals align with theirs.

Conclusion

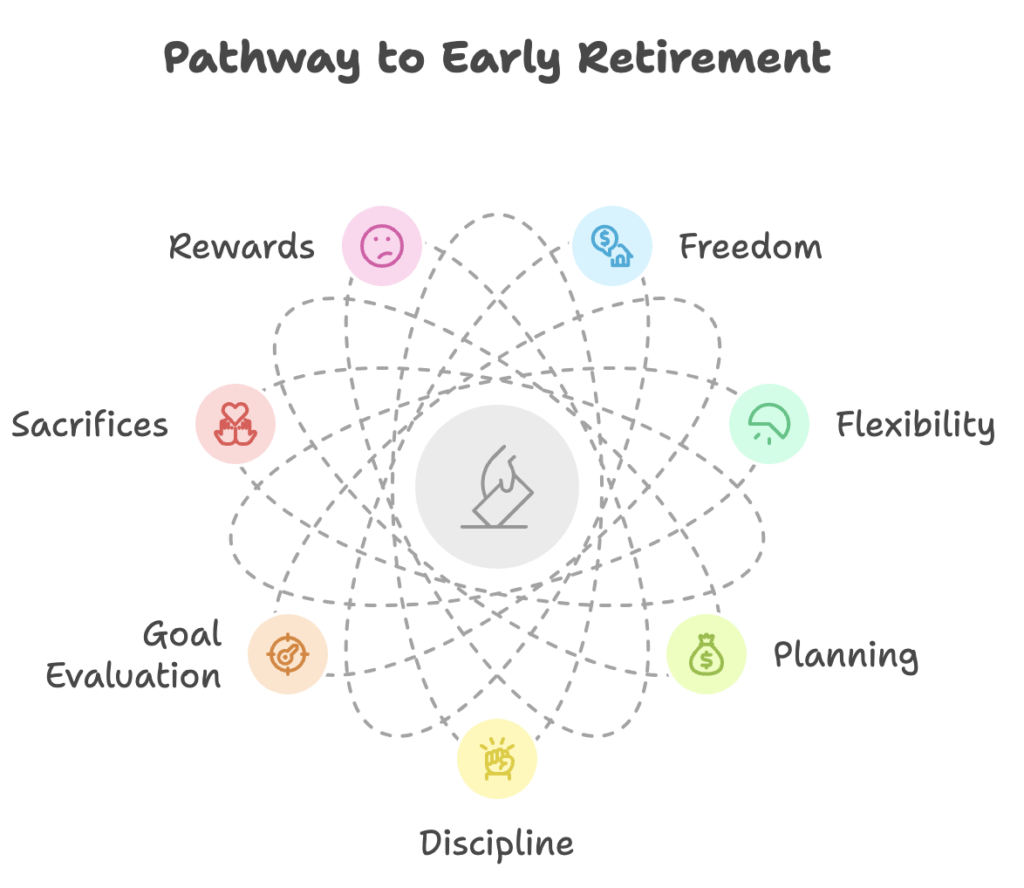

Early retirement is a dream for many, offering freedom, flexibility, and the chance to live life on your own terms. But it’s not without its challenges. By planning carefully, staying disciplined, and evaluating your goals, you can determine whether early retirement is the right path for you. The journey may require sacrifices, but the rewards are worth it for those who value time and independence above all.

FAQs

- What is the 4% Rule, and how does it help with early retirement?

The 4% rule suggests withdrawing 4% of your savings annually to ensure your funds last for 30+ years. It’s a guideline for managing retirement finances effectively. - How much money do I need to retire early?

This depends on your lifestyle and expenses. Many experts recommend having 25-30 times your annual expenses saved. - What are some risks of retiring early?

Risks include running out of money, unexpected healthcare costs, and potential loss of purpose or social connections. - How can I find purpose after early retirement?

Engage in hobbies, volunteer work, or part-time jobs that align with your passions and values. - Can I retire early and still work part-time?

Yes, many early retirees choose part-time work or freelancing to supplement their income while enjoying flexibility.