Understanding Downsizing in Retirement

What Does Downsizing Mean?

Downsizing refers to the process of moving to a smaller, often more affordable home, typically after children have moved out or during retirement. It’s about simplifying your living situation to match your current lifestyle and needs. For retirees, this often means trading the large family home for a cozy condo, a single-story home, or even a retirement community.

Why Do Retirees Consider Downsizing?

The reasons vary but are often tied to financial and lifestyle goals. Some seek to cut costs, others aim to reduce the burden of maintaining a large property, and some are simply looking for a change that better suits their retirement lifestyle. Whatever the reason, downsizing can be a transformative step.

Pros of Downsizing

Financial Benefits

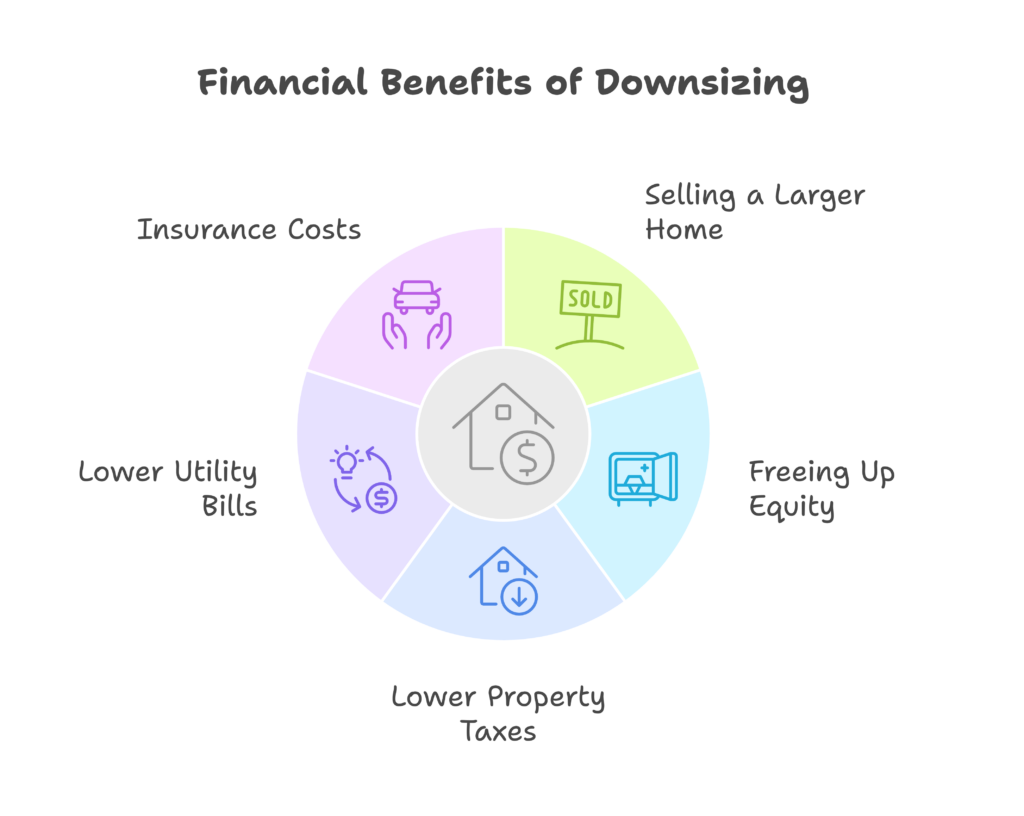

One of the biggest perks of downsizing is the financial relief it can bring. By selling a larger home, you can potentially free up significant equity to bolster your retirement savings. A smaller home often means lower property taxes, utility bills, and insurance costs. These savings can give you more flexibility to enjoy retirement.

Reduced Maintenance

Large homes require more upkeep—cleaning, repairs, lawn care, and more. Downsizing allows you to move to a property that requires less maintenance, saving you time, effort, and money. For retirees, this means more time to enjoy hobbies, travel, or simply relax.

Simplified Living

There’s a certain freedom in letting go of unnecessary possessions and living in a more manageable space. Downsizing forces you to prioritize what truly matters, which can lead to a more minimalist and stress-free lifestyle.

Cons of Downsizing

Emotional Challenges

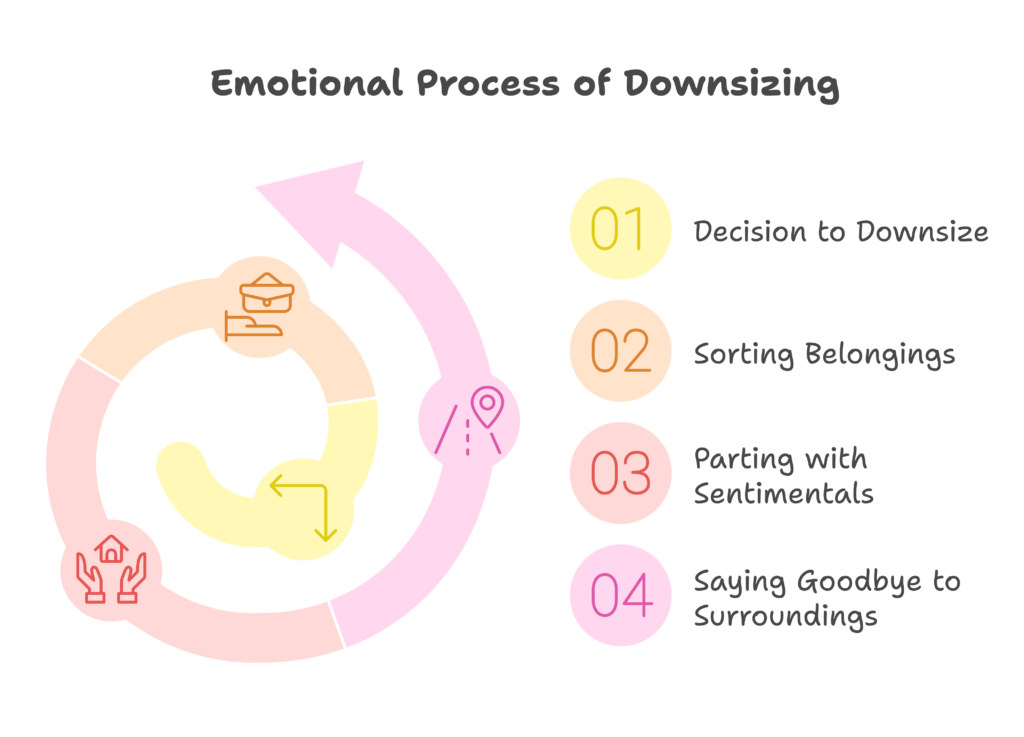

Leaving a home filled with decades of memories can be emotionally taxing. The process of sorting through belongings, parting with sentimental items, and saying goodbye to familiar surroundings can feel overwhelming.

Space Limitations

Moving into a smaller space means making sacrifices. You may have to let go of certain furniture, mementos, or even hobbies that require extra room. Adjusting to less space can be difficult, especially if you’re accustomed to spreading out.

Costs Associated with Moving

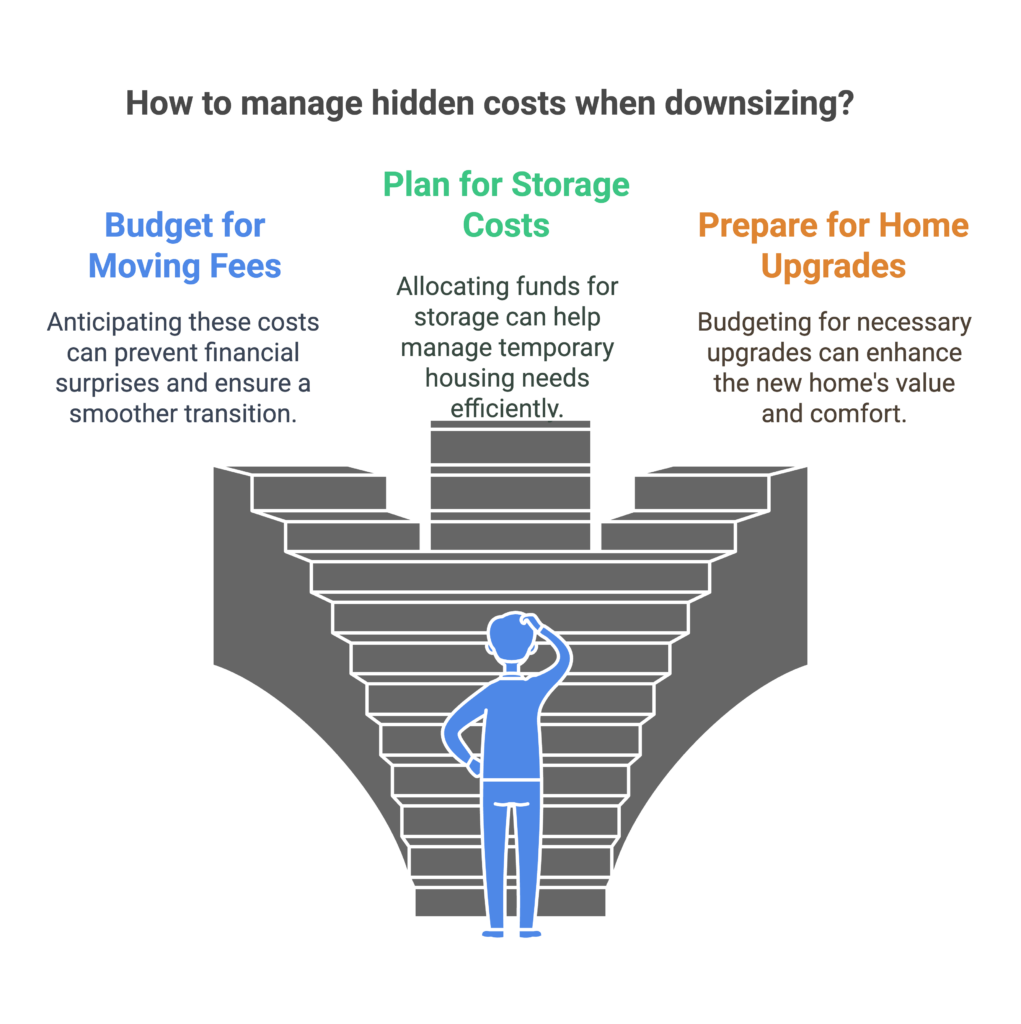

While downsizing can save money in the long term, the process itself isn’t cheap. From realtor fees and moving expenses to potential renovations or repairs needed to sell your current home, these upfront costs can add up quickly.

Is Downsizing Right for You?

Evaluating Your Financial Goals

Take a close look at your retirement budget. Will selling your current home and moving to a smaller one improve your financial outlook? Calculate potential savings versus moving costs to see if downsizing aligns with your financial objectives.

Considering Lifestyle Changes

Think about your daily life. Do you want to travel more, focus on hobbies, or spend time with family? Downsizing can help you achieve these goals by simplifying your living situation and freeing up resources.

Weighing Emotional Readiness

Are you ready to let go of your current home? This step requires emotional preparation, especially if you have deep attachments to your space. Talk with loved ones and take time to process this change.

Tips for a Smooth Downsizing Transition

Start Decluttering Early

Don’t wait until the last minute to start going through your belongings. Begin decluttering months before the move. Sort items into “keep,” “donate,” and “discard” piles to make the process more manageable.

Research Housing Options

Look into all available options, from condos and townhouses to retirement communities. Consider proximity to family, healthcare facilities, and amenities that suit your lifestyle.

Plan for Hidden Costs

Unexpected expenses can arise, such as moving fees, storage costs, or necessary upgrades to your new home. Budget for these extras to avoid surprises.

Conclusion

Downsizing for retirement can be a life-changing decision with both rewards and challenges. It’s about balancing your financial goals, lifestyle preferences, and emotional readiness. By carefully weighing the pros and cons and planning ahead, you can make the transition smoother and more fulfilling.

FAQs

1. What are the financial benefits of downsizing for retirement?

Downsizing can free up equity, reduce monthly expenses like utilities and property taxes, and potentially eliminate a mortgage, giving you more financial freedom.

2. How can I decide if downsizing is the right choice for me?

Evaluate your financial goals, lifestyle needs, and emotional readiness. Consider consulting with a financial advisor to see how downsizing fits into your retirement plan.

3. What are some common challenges people face when downsizing?

Emotional attachments to the current home, adjusting to less space, and managing moving costs are common challenges retirees face during the downsizing process.

4. Are there alternatives to downsizing for retirees?

Yes, alternatives include aging in place by modifying your current home, renting out parts of your home, or moving in with family members.

5. How can I prepare emotionally for the downsizing process?

Take time to reflect on the change, involve loved ones for support, and focus on the opportunities downsizing can bring, such as new experiences and less stress.